The 100 Most Overpaid CEOs 2015

CEO pay has grown nearly 1,000% over the past four decades, far exceeding growth in median worker pay or company share prices. Our new report, The 100 Most Overpaid CEOs: Executive Compensation at S&P 500 Companies, highlights the 100 most overpaid CEOs and examines the forces behind the trend of ever-increasing CEO pay.

Skyrocketing CEO pay packages represent a misallocation of assets that is detrimental to investors, and a driver of wider social inequality. Using a methodology that combines statistical analysis and an in-depth examination of over 30 ‘red flag’ indicators, the report found widespread consensus on the worst actors, companies with huge pay packages that showed relatively weak shareholder returns.

The report also examines the voting records of mutual funds on executive compensation packages, identifying those that are uncritically rubber-stamping the recommendations of the compensation committees. This is an issue that affects everyone – the pay packages analyzed in this report are from the companies that the majority of retirement funds are invested in. If someone has a 401(k) through their employer, it’s likely they are invested in a company with an overpaid CEO.

Most CEOs have come to be grossly overpaid, and that overpayment is harmful to the companies, the shareholders, the customers, the other employees, the economy, and society as a whole.

In addition, members of the compensation committees that recommend these excessive pay packages are put under the microscope, with a focus on those serving on multiple committees of companies on the 100 most overpaid list.

Excessive and poorly structured CEO pay packages don’t just take money from shareholders and pose a risk for the destruction of shareholder value, they also prevent corporations from paying decent wages to their employees. Institutional and individual investors should be re-examining their assumptions and advocating for more reasonable CEO pay and to hold members of the board accountable.

To learn about the 100 most overpaid CEOs, the compensation committee members recommending the pay packages, and the mutual funds rubber-stamping excessive CEO pay, download the full report above.

KEY FINDINGS

Download the webinar slides

There is consensus on the worst actors: two different models were used to analyze pay – one statistical and one that is a comprehensive analysis of data points – and both largely agreed on the worst offenders. The first 11 companies listed below appeared on the top 25 generated by both methods. The statistical analyses, which used financial performance measures to identify pay based on performance, and determined an amount in excess of that prediction, showed similar results over various financial ratios and time periods, and are likely similar to those performed by proxy analyses firms. As You Sow also considers 30 other factors, generally ranking companies and giving red flags to those that exceeded a certain threshold.

The most overpaid CEOs represent an extraordinary misallocation of assets. Regression analysis showed each of the top nine most overpaid had compensation at least $20 million more than if their pay had been appropriately aligned with performance. This understates the true cost to shareholders, because at the start point of the regression analysis, five years ago, the escalation of compensation packages was well advanced.

The pay packages analyzed in this report are the companies that the majority of retirement funds are invested in.

There is a tremendous range in mutual fund focus and voting on this issue. Of the largest mutual funds, American and Schwab approved less than 60% of these packages, while Blackrock supported 95% of them. Some funds seem to routinely rubber-stamp management pay practices, enabling the worst offenders and failing in their fiduciary duty. One surprise: TIAA-CREF – the leading retirement provider for teachers and college professors – is more likely to approve high pay packages than almost any other institution its size.

Directors who should be acting as the stewards of shareholder interests have too often compromised on that responsibility, and need to be held accountable. We list the companies that over-paying directors serve on, and identify 17 individuals who serve on two or more “overpaid” S&P 500 compensation committees. We identify one director who was paid more than $1 million to serve on compensation committees in FY 2013.

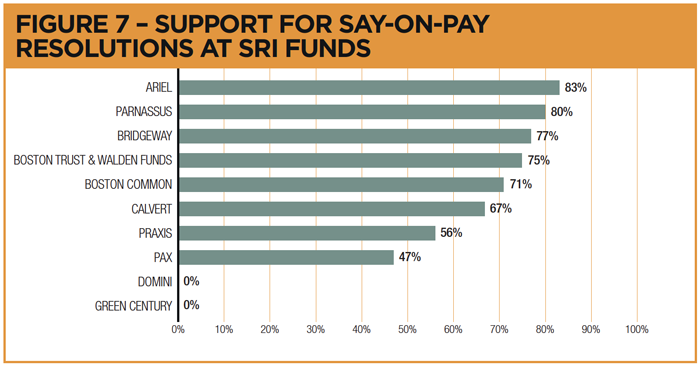

Some mutual funds seem to routinely rubber-stamp management pay practices, enabling the worst offenders and failing in their fiduciary duty. Support for high CEO pay packages at public pension funds is mixed, while socially responsible investor (SRI) funds were more likely to vote against excessive pay packages.

SOURCE: Fund Votes

SOURCE: Fund Votes

SOURCE: Fund Votes

The data shows that there is virtually no correlation between CEO pay and shareholder returns.

SOURCE: HIP Investor, Institutional Shareholder Services Inc., and Thomson Reuters